A diplomatic deal in the Middle East was notable as much for a breakthrough between Saudi Arabia and Iran as it was for the absence of American input.

Story by Brendan Cole

The March 10 agreement between the regional rivals to imminently reopen embassies after a seven-year hiatus was brokered in secret by China. It raised questions over whether Riyadh had lost trust in Washington as a defender of its security and showed waning American influence in the region.

It also demonstrated the ability of Beijing to mend ties severed in 2016 when Iranian protesters attacked Saudi diplomatic missions in Tehran following Riyadh’s execution of revered Shiite Muslim cleric Nimr al-Nimr.

“The Chinese have now shown that they have the ambition and the ability to play the role of mediator on the world stage,” said Trita Parsi, executive vice president at the Quincy Institute for Responsible Statecraft in Washington. “This is happening at a time when the U.S. is increasingly embroiled in major conflicts and, as a result, has a limited ability to play a diplomatic role.

“If this becomes the new norm, in which China is a peacemaker and the U.S. is involved in conflicts, it will negatively impact America’s global influence and help China portray itself as a peaceful nation and a stabilizing force in the world.”

Last week, Parsi co-wrote an article in Foreign Affairs that said Washington feared growing Chinese influence in the Middle East and had left a diplomatic vacuum Beijing was happy to fill.

The piece outlined how Riyadh had expected a U.S. response to an attack on Saudi oil facilities in September 2019, carried out by Iranian-backed Houthi rebels in Yemen. When none was forthcoming from then-President Donald Trump, Riyadh reassessed its view that it could depend on Washington, making direct diplomacy with Tehran more attractive.

China’s initiative signed this month was foreshadowed by American missteps in the region. President Joe Biden was criticized for the drawdown of American troops from Afghanistan in August 2021, while last summer, he could not get Riyadh to increase oil production to ease U.S. gas prices.

“Coming on the heels of the U.S. withdrawal from Afghanistan, this represents a further defeat for U.S. diplomacy,” Alan Cafruny, professor of international affairs at Hamilton College in New York, told Newsweek.

Although the U.S. still retains influence in Riyadh, Cafruny believes the deal could mean a revival of the Joint Comprehensive Plan of Action (JCPOA), which he said is “something the United States would be well-advised to support.” Trump in 2018 pulled Washington out of the 2015 agreement limiting Iran’s nuclear program.

All Three Sides Were Winners

China’s interests in the Middle East have deepened. Beijing reportedly promised Iran in 2021 to invest $400 billion in exchange for oil and fuel supplies. China is also Saudi Arabia’s largest trading partner and one of its largest oil suppliers.

“This deal happened because all three sides were winners,” said Ammar A. Malik, a senior research scientist at William & Mary’s Global Research Institute in Virginia.

“Saudi Arabia is trying to focus on its domestic economic reform agenda by disengaging with regional conflicts on the back of bumper oil revenue years,” he told Newsweek. “Iran is struggling to cope with internal protests and trying to put their economy on a growth trajectory.

“China has been keen to bring Iran out of the sanctions regime and this might be a step in that direction.”

Mohammad Elahee, professor of international business at Quinnipiac University in Connecticut, said that Saudi Arabia is ready to look beyond the U.S. and “may even take steps that will cause consternation in the U.S.”

However, given American supplies of military hardware, technology transfer and private investment to the kingdom, he said that China is “decades away from building the sort of deep ties that the U.S. enjoys with Saudi Arabia.”

“One should not discount the fact that no other country in the world comes even close to the U.S. in terms of exerting coercive power and marshaling resources from its global alliance in a short notice,” Elahee said.

Antonio Fatas, economics professor at the business school INSEAD in Singapore, said Saudi Arabia was capitalizing on its strong hand because of the global energy crisis and saw a chance “to create some dissatisfaction in the West without facing retaliation.”

“They do not like the strong role that the U.S. has played for years in the region and they prefer to see a weaker U.S., even if this means making China stronger,” he told Newsweek.

Regional Impact

The Chinese deal might be on a par with the Abraham Accords of 2020, a series of normalization statements initially between Israel, the United Arab Emirates and Bahrain. It could also have a similar impact on the region, easing conflicts ranging from Syria to Yemen.

“There are questions that remain, such as how China can be a guarantor of the Saudi-Iranian agreement and how China will act if the agreement falls through,” said Buğra Süsler, visiting fellow at LSE IDEAS, a London School of Economics think tank.

China Could Be Key to Ending Ukraine War

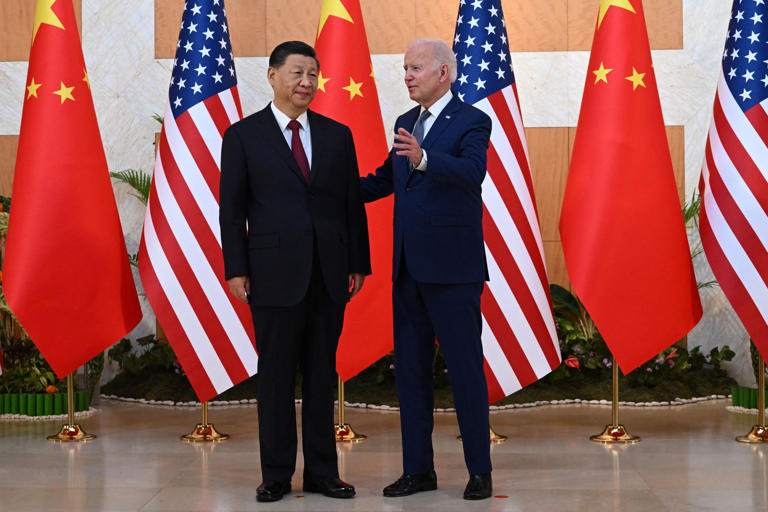

Chinese President Xi Jinping is visiting Moscow this week, and Beijing, officially neutral on President Vladimir Putin‘s war, has increased trade with, and hence leverage over, Russia.

It is not clear what Xi knew ahead of Putin’s plans when they met before his February 24, 2022, invasion of Ukraine. But neither Moscow nor Kyiv have rejected outright China’s 12-point position paper released last month about how to end the war. An op-ed by Xi published by Russian media on Monday ahead of the visit hinted that Beijing could bring an end to the hostilities.

Cedomir Nestorovic, from the ESSEC Business School Asia Pacific in Singapore, believes that if the Chinese can resolve conflicts in the Gulf, “they can do so in Ukraine as well.”

“China is accepted by both parties, which is not the case for the United States,” he told Newsweek. “If China can mediate in Ukraine, they may also contribute to the de-escalation of the crisis in the Taiwan Straits, so the Gulf deal could be just a beginning of China’s active contribution to peace.”

However, Nestorovic said China could also consider the prospect of Saudi Arabia and Iran becoming members of the BRICS (Brazil, Russia, India, China, South Africa) bloc of emerging economies. This would secure Beijing’s energy requirements, marginalize American influence in the Gulf and force the U.S. to put more effort in the region.

“The United States is a powerful country, but maybe not powerful enough to stretch its forces simultaneously in the Gulf, the Black Sea and the South China Sea,” Nestorovic said. “That is an idea China may be interested in, especially in the context of the China-Taiwan relationship.”

Relations between Saudi Arabia and Iran have ebbed and flowed since the 1979 Iranian Revolution, during which there have been times of intense rivalry and détente, and this latest deal could just be part of that cycle.

Nader Hashemi, director of the Center for Middle East Studies at the University of Denver, said that the China deal has not extinguished underlying differences between the regional rivals.

“America’s influence has waned in the region, but I think we have to be very cautious in assuming that the tide has radically shifted away from American influence or Western influence in the region and China now is the dominant player,” he told Newsweek.

He said that Republicans retaking the White House in 2024 could change the calculus and see a return “to the period of conflict that we saw between 2016 and 2020, when Trump was trying to pressure and antagonize Iran and Saudi Arabia was very much backing that effort.”

Meanwhile, Riyadh is reportedly seeking security guarantees from the United States in exchange for normalizing relations with Israel. This would entail Riyadh looking for American help in developing a civilian nuclear program and fewer restrictions on arms sales, according to The New York Times.

“The U.S. administration understands they will have to provide such guarantees as part of a deal,” Efraim Chalamis, New York University professor and fellow at the Kroll Institute, told Newsweek. “Because of the Iranian economic crisis, Iran needs foreign investment Iran and more goods from places like Saudi Arabia. But at the same time, because of U.S. sanctions, Saudi Arabia will not be interested in exposing itself, or its own private companies, to all types of sanctions.

“I can envision that the U.S. is providing this kind of security umbrella and making sure that Saudi companies are subject to sanctions, while Saudi Arabia in a pragmatic manner are signing and promoting all types of security agreements with Iran.”

Source | Newsweek