THE global market for natural gas is ripe, making the next month’s signing agreement between the government and major oil investors timely and worth it.

Recently, the government said it envisaged signing the key 40 billion US dollars agreement for Liquefied Natural Gas (LNG) project with Equinor ASA and Shell Plc to pave way for exports after completing the fiscal package discussions. Others in the project are ExxonMobil, and Pavilion Energy.

“This is commendable and good for the economy, not only on the FDI (Foreign Direct Investment) and employment creation part, but also as a sustainable source of foreign exchange,” Alpha Capital Head of Research and Financial Analytics, Imani Muhingo told the ‘Daily News’, on Sunday.

Mr Muhingo said the completion of the discussion and signing of the deal is timely, adding that the “market is ripe”, especially now, when Europe hastens to untangle from Russian energy dependence.

The project was delayed by years of prolonged negotiations but gained urgency as European countries look for LNG projects that can be long-term replacements for energy supplies from Russia.

The Minister for Energy January Makamba was quoted recently saying that the accords will include a final Host Government Agreement (HGA), setting out the project terms, as well as the project law and benefit-sharing agreement.

A final investment decision could be reached in January 2025, allowing exports to start before 2030, Mr Makamba said.

The country’s natural gas reserves are estimated at 57 trillion cubic feet with a total annual production of 110 billion cubic feet from three fields in Songo Songo, Mnazi Bay, and Kiliwani North.

Commenting, Dr Hildebrand Shayo, an economist-cum-investment banker, said natural gas exports will have additional macroeconomic benefits, including the balance of payments and foreign exchange earnings that when efficiently used and allocated, will help the government meet the public needs of the voters.

“Unquestionably,” Dr Shayo said, “it is predictable that prospective exporters like Tanzania will help, rather than hurt its economy”.

Also, he said, there is an additional benefit to LNG exports that is unquantifiable: Its impact on geopolitics.

“The additional volumes of the country LNG will be beneficial to the global gas market, potentially helping Tanzania allies and development partners that are dependent on natural gas for energy,” Dr Shayo said.

He said the country’s export volumes are unlikely to transform the fragmented structure of existing LNG trade, but will rather provide liquidity to natural gas consumers around the world, potentially improving the energy costs for consumers in natural gas-dependent countries.

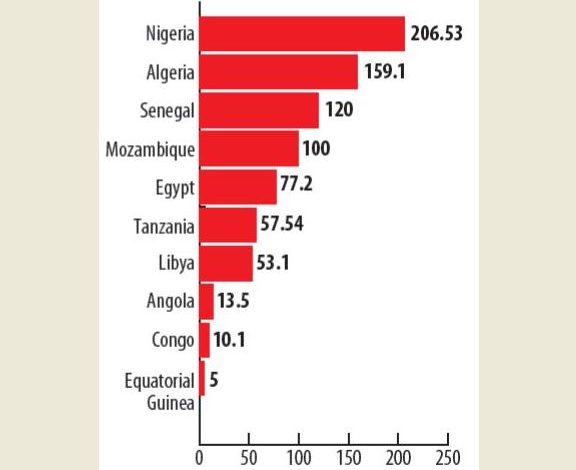

Africa’s natural gas reserves are over 620 trillion cubic feet as of last year. Tanzania, with 57.54 trillion cubic feet stands at the sixth position in the top ten countries with abundant natural gas reserves in the continent.

The list is led by Nigeria housing the largest reserves in the continent, around 206.53 trillion cubic feet – equivalent to roughly three per cent of the proved global natural gas reserves.

In addition, North Africa accounted for nearly half of the continent’s total gas reserves, with Algeria concentrating the highest amount, some 159 trillion cubic feet. The list in descending order also has Senegal with 120 trillion cubic feet, Mozambique (100 trillion cubic feet), Egypt (77.2 trillion cubic feet), Tanzania (57.54 trillion cubic feet), Libya (53.1 trillion cubic feet), Angola (13.5 trillion cubic feet), Congo (10.1 trillion cubic feet) and Equatorial Guinea at 5 trillion cubic feet.

- Nigeria – 206.53 trillion cubic feet

- Algeria – 159.1 trillion cubic feet

- Senegal – 120 trillion cubic feet

- Mozambique – 100 trillion cubic feet

- Egypt – 77.2 trillion cubic feet

- Tanzania – 57.54 trillion cubic feet

- Libya – 53.1 trillion cubic feet

- Angola – 13.5 trillion cubic feet

- Congo – 10.1 trillion cubic feet

- Equatorial Guinea – 5 trillion cubic fFeet

According to www.energycapitalpower.com