Edson Baraukwa | Africa Guardian

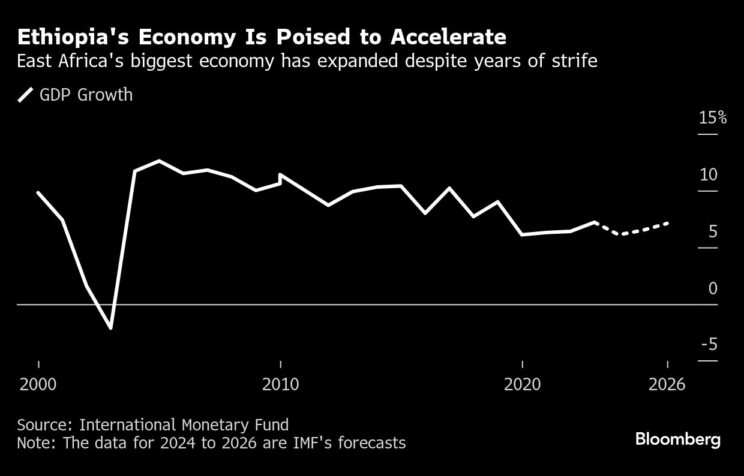

Ethiopia is reintroducing a stock exchange after more than 50 years, marking a significant step toward attracting foreign investment as it recovers from internal conflict and strives for economic growth. The country, which saw an average growth rate of 8% over the past decade, aims to position itself as a key player in Eastern Africa’s economic future.

Ethiopia Investment Holdings, managing 40 state-run companies, is kicking off the process by listing shares of Ethio Telecom in an initial public offering (IPO), which is expected to raise up to 30 billion birr ($234 million). This marks the beginning of the new Ethiopian Securities Exchange, set to officially open on Friday. The government plans to list additional companies in the coming years to bolster economic activity.

Despite the challenges, including a devastating civil war that resulted in 600,000 casualties, Prime Minister Abiy Ahmed’s administration has reached a peace agreement and is now focused on creating jobs in a nation with a significant youth unemployment rate. The stock exchange is seen as a crucial part of the country’s efforts to attract investment and generate economic growth.

James Johnstone, co-head of emerging and frontier markets at Redwheel, highlighted that the opening of the stock exchange represents an exciting opportunity for Ethiopia’s growing economy, which has so far been largely underrepresented in international investment.

The Ethiopian government has also implemented significant economic reforms, such as ending the half-century-long control over the currency, unlocking financing from the World Bank and International Monetary Fund. To further support investment, Ethiopia has made capital markets more investor-friendly, ensuring ease in repatriating funds.

However, challenges remain, including Ethiopia’s low foreign-exchange reserves, which stood at $1.5 billion in March, according to the IMF. Despite this, a $3.4 billion IMF bailout is expected to stabilize the country’s foreign-exchange position, though liquidity concerns persist.

Abiy’s government has plans to introduce regulations that will encourage longer-term investments and reduce the risk of volatile “hot money” flows. Ethiopia is targeting up to 50 listings on the stock exchange within the next five years, including some companies via a process known as listing by introduction, which doesn’t require an IPO.

While the stock exchange’s return to Ethiopia marks a significant milestone, there are concerns about ongoing ethnic tensions and regional instability, particularly in Oromia and Amhara, which may impact investor confidence. Despite these challenges, the government’s commitment to foreign investment, including the opening of the banking sector and approval of foreign investments in key sectors like coffee and oilseed exports, demonstrates its focus on economic growth.

However, Ethiopia still faces obstacles, such as the absence of brokers or custodians on the new exchange, and issues around its $1 billion in eurobond restructuring. Despite these hurdles, officials are optimistic that the reforms will ultimately pave the way for a thriving financial market.

“The remaining tasks should be relatively straightforward now that we’ve addressed major issues like foreign exchange,” said Tilahun Kassahun, CEO of the Ethiopian Securities Exchange.

The launch of the stock exchange is expected to be a key step in Ethiopia’s efforts to revitalize its economy and strengthen its position on the global investment map.

___